Garden markets 2023/2024: opportunities ahead

The markets of Home improvement, from DIY to gardening tools, have undergone significant changes since the Covid-19 pandemic. If the overall status by the end of December 2023 can be seen as negative, the fall in sales is moderate compared to the Tech & Durables goods markets: -4% for DIY and -1% for gardening. The studies by GfK x NielsenIQ revealed that many products are still dynamic and that practices are well established among consumers. Therefore, some interesting perspectives are still open for home improvement actors.

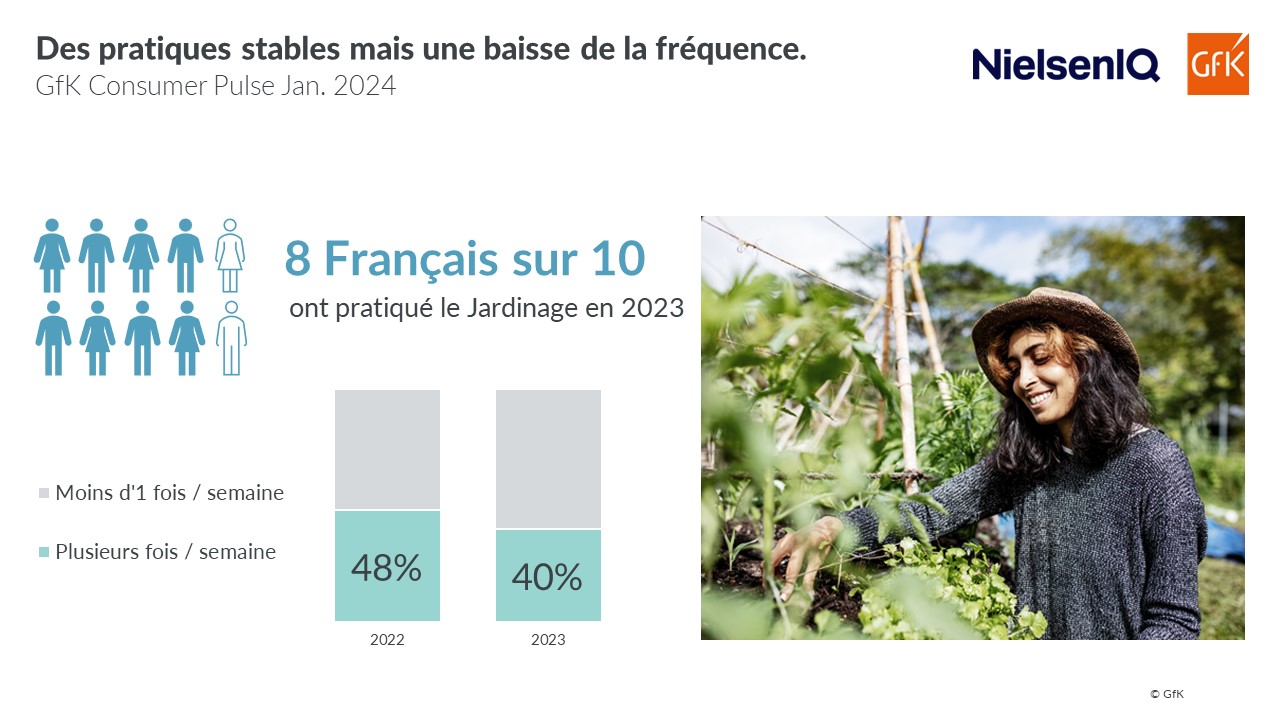

8 French people / 10 do gardening

After the post-pandemic boom in 2021, DIY and gardening markets returned to a more stable rhythm. Sell-out data audited by GfK x NielsenIQ show a contained decline in 2023: € 53 billion as DIY 2023 turnover (-4%) and € 31 billion for Gardening (-1%). On the other hand, PetCare sales remain very dynamic, up 22% to € 13 billion total turnover

Several factors help to explain and set this fall into perspective. On the one hand, gardening remains highly practised: 8 out of 10 French people do it regularly, even if the frequency reduced very slightly compared to lockdown periods of 2020 and 2021. On the other hand, the hard economic context directly impacted French consumers' projects, specially those for building and renovation. Almost a third of projects has been cancelled in 2023, from property purchases to extension or renovation work.

Garden products still blooming in 2023

If markets are impacted by choices French consumers had to make to face the difficult economic situation, as well as the impact of the weather on sales, they are not in deep crisis.

Some categories did suffered of the heavy rains late spring 2023 while products were put on the shelves. Definitely, weather did dampen the will-to-buy of potential customers on watering products and barbecues, as they fell by 59% and 81% respectively in 2023. In contrast, boots (+106%), pumps (+4%) and garden products (+27%), including household insecticides, benefited from these particular external conditions and increased their sales. Motorised equipment, key pilar of the Garden market, also recorded a slight increase in turnover (+0.6%).

At the same time, purchasing patterns remained very similar to the previous year: French buyers did not churn from their favorite channel to another. DIY superstores are representing 40% of garden spendings in 2023. Specialist garden stores accounted for 27% of revenue, and garden centers/LISA for 25%.

3 growth opportunities

Despite the still difficult economic climate, there are a number of opportunities in 2024 and beyond. Among them, GfK x NielsenIQ experts point out :

- Smart Home

After a post-pandemic sales boom, sales of Smart Home products somehow paused in 2023, reaching €357 million for the automation/security category which is 11% of the market value.

Some key features are strongly related to consumers’ needs and so showing growing adoption. Let’s mention security-related uses and 75% of sales of alarms & cameras related to connected references. Another example is the ease of use and the rise of robotic lawnmowers sales (+ 23% in 2023), thanks to the field setting and remote control functions. Another sensitive issue, made easier thanks to Smart Home products, is the search for energy savings. In 2023, sales increase of programmable thermostats and connectable electric heaters were noticeable. We can bet that interoperability between systems and functions based on AI will offer even more, and so convert consumers in the months to come.

- Organic/Natural

While the French have reduced strongly their purchases of organic food, not the same situation in the garden field ! Organic and natural products in the potting soils and fertilizers categories saw their sales increasing by 2% in 2023. Now organic references represent 55% of potting soils turnover, and 47% for organic fertilisers.

The trend is also clear in pet food! If natural products still account for less than 20% of sales, they shown strong growth, up to +17% for dogs and +34% for cats in 2023.

- Battery-powered products

The use of cordless equipment is still gaining ground among amateur gardeners and DIY enthusiasts. Battery-powered products generated €550 million of revenue in 2023, up 15% compared to 2022. The increase is significant looking back to pre-pandemic sales: battery-powered products now account for 1 products sold out of 3 in garden machinery (up 14 points since 2019) and 42% in hand-held power tools (up 8 points). Consumers seem to have found a balance between bare products and compatible batteries already in their possession, with 34% of sales being ‘bare’.

- E-commerce

Online shopping is appealing because of the convenience of home delivery, the ease of comparison and the feeling of being able to grab more bargains. Logically, then, retailers have invested more in their online garden sections, as their range is now structured around high-tech products.

Among the 28 categories of garden and decoration products audited by GfK x NielsenIQ, 2023 results show that online sales are more dynamic than in-store sales, with a gap ranging from +10 to +20 points. The penetration of e-commerce is growing steadily in the Home Improvement sector, ranging from 15% for heating/air conditioning equipment to 33% for tools. Therefore, market players need to consider the online channel as an essential part of the consumer journey.

Outlook for 2024

The outlook for 2024 should be brighter, despite a still difficult economic climate. Positive signs are emerging, particularly in the organic/natural, connected and battery-powered segments.

Property and building projects could be boosted by lower borrowing rates and a slowdown in inflation. According to the GfK Consumer Pulse survey (January 2024), 26% of French people are planning to renovate part of their home in the next 18 months, and more than half are considering more important projects, such as heating systems, external works. In order to achieve those projects, consumers are planning to be more strategic in their purchases, making greater use of promotions and carrying out more in-depth research before buying.

At last, eco-responsible criteria are becoming increasingly important for French consumers: 74% consider energy labels as key criteria of choice, and the “reparability index” has risen by 5 points in 2023, reaching 61%. Initiatives such as corners selling reconditioned or second-hand products are also important ways of boosting sales. Hire is also a key issue, especially in the gardening sector, where the low frequency of use of certain equipments argues in favour of shared use.

In conclusion, the gardening market offers many opportunities despite the current challenges, and industry professionals can take advantage of emerging trends to stimulate growth and meet changing consumer expectations.